- 10x Market Updates

- Posts

- Friday was a PIVOTAL turning point for Stocks & Crypto!

Friday was a PIVOTAL turning point for Stocks & Crypto!

Helping EVERYONE to make better crypto investment decisions.

👇 1) Consensus: Wallstreet commentators have been warning for several quarters that a) inflation would be sticky and b) the U.S. economy would enter a recession in 2023. Stocks (SP500 +11%, Nasdaq +27% and Bitcoin have been rallying nevertheless YtD). Slowly, those commentators have come around that inflation is indeed coming down leaving them with their US recession view to worry about.

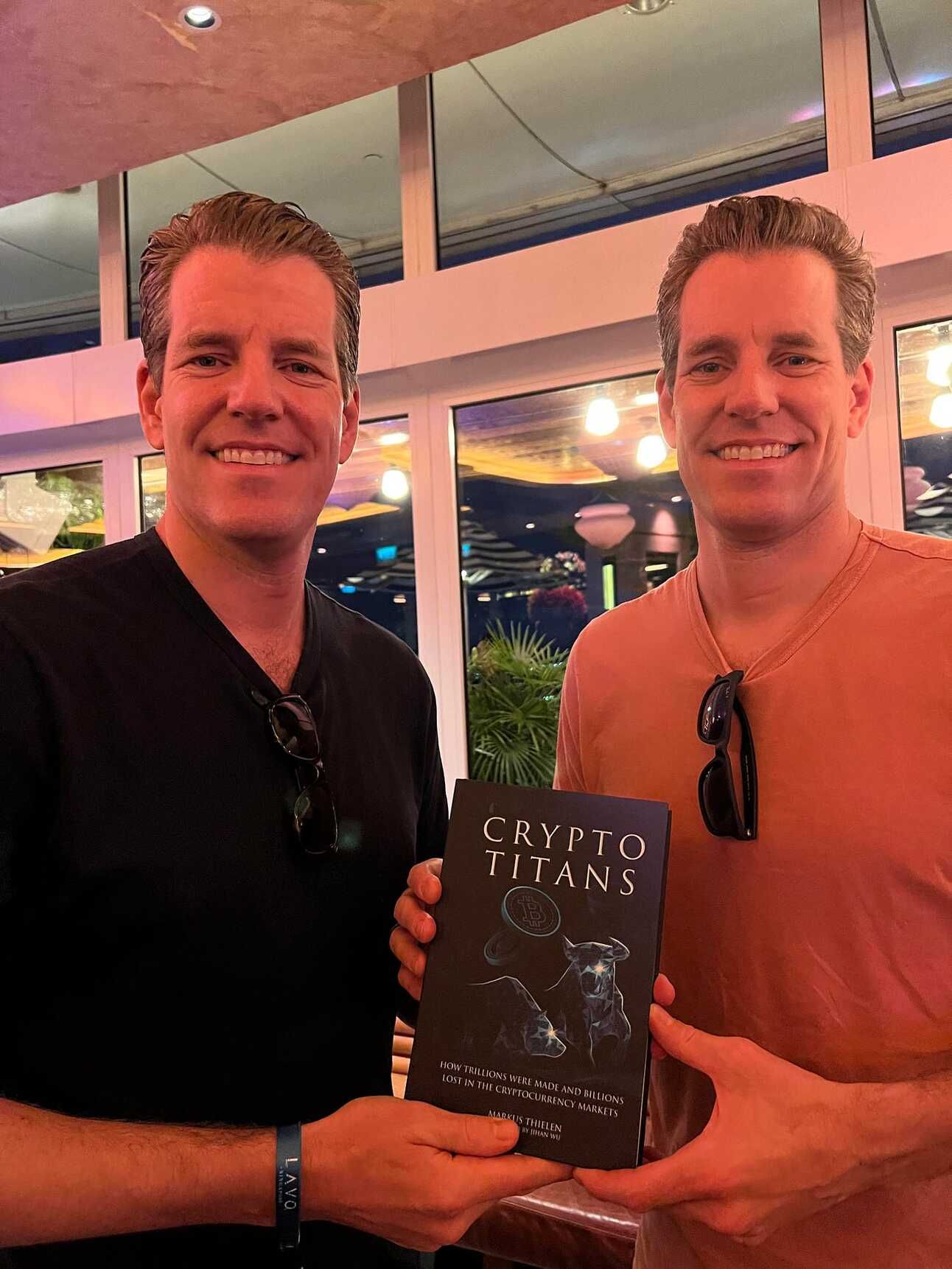

Exhibit: Consensus expected a recession in 2023

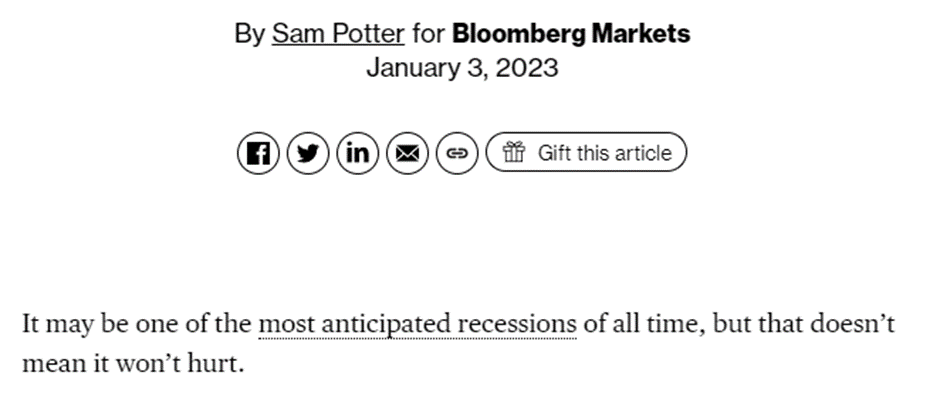

👇 2) Economic facts: Last Friday's U.S. employment report surprised above expectations for the 14th consecutive time, another sign that market forecasters were too bearish and that the U.S. economy is far from entering a recession. As a result, economy-sensitive stocks (SP500 and Russell 2000) outperformed tech stocks. This could be the START of the outperformance of Financials > Tech stocks as the domestic economy starts to pick up.

Exhibit: Nonfarm payrolls remained above expectations for 14 months now

👇 3) Trading call: Our MAJOR trading call is to switch out of tech (we have been bullish since December 2022) and move into financials. The Fed has finished its rate hiking cycle and despite the U.S. yield curve inversing deeper and deeper, the banking crisis of March 2023 appears to be fully priced in and investors could allocate into this laggard sector. While the odds for tech to rally are still strong (MSFT +10% next 3 months according to our model), the underweighted sectors could see the most significant rally.

Exhibit: Banks (XLF) vs. Tech - underperformance of -31% could reverse

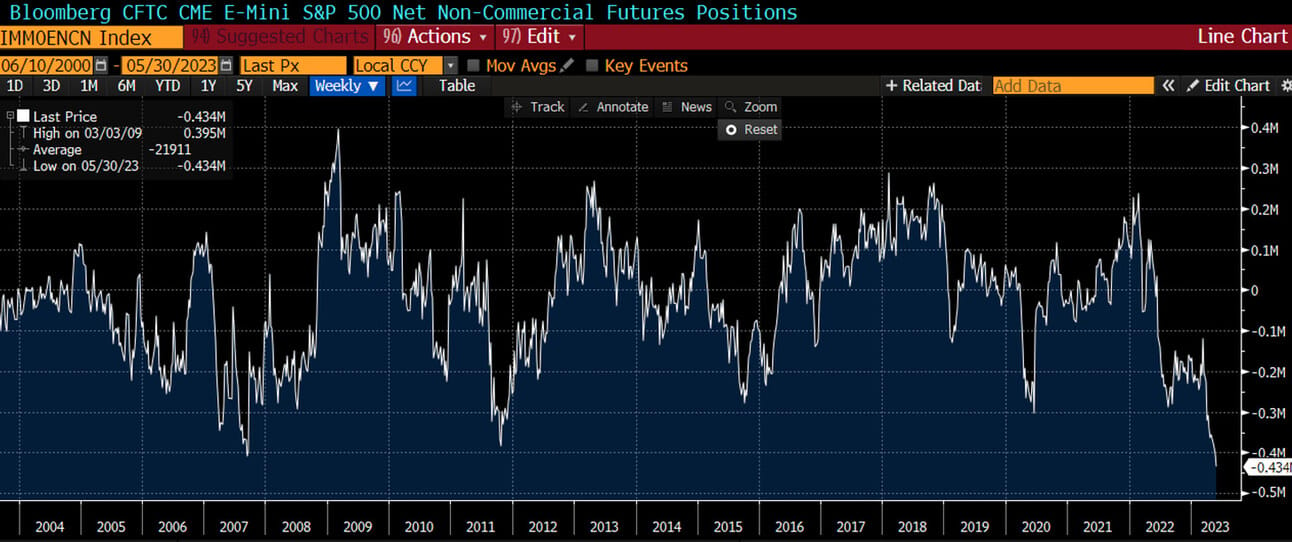

👇 4) Positioning: SP500 speculative futures positions are at multi-decade lows (shorts), a sign that many traders bought into the FALSE narrative that the U.S. debt ceiling matters, inflation would remain elevated and the U.S. economy would enter a recession. None of those narratives appear to occur, forcing those short positions to be covered and SQUEEZING the market higher.

Exhibit: SP500 hedge fund futures positions at multi-decade “short”

👇 5) Firepower: Data from Ultra-High-Net-Worth shows that their cash allocation has increased from 23% to 34% and their cautious stance has resulted in a significant underperformance year-to-date. Our tech-focused portfolio is up +40% YtD and the next leg higher could be driven by the real-economy stocks as the recession call is being priced out.

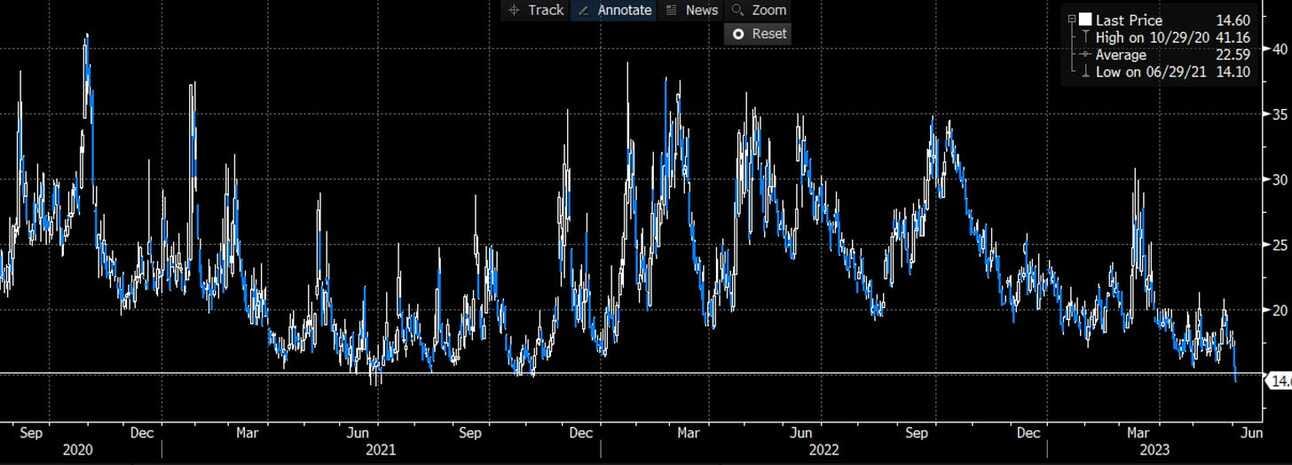

👇 6) Convexity: Volatility = Risk and the volatility index (VIX) has declined to multi-year lows at 15%, supporting portfolio managers to deploy more capital and increase their net LONG positions. Buying stocks and hedging the risk with puts suddenly only costs half as much.

Exhibit: VIX index at multi-year lows

👇 7) Seasonality: Equity markets are also entering the quieter summer months, where natural buying (from pension funds etc.) dominates and pushes the market higher. The last time the Nasdaq declined in July was in 2007.

👇 8) Consumer spending: Glancing at airline ticket prices this summer, everybody will release that consumer spending remains extraordinarily strong and despite a shift higher in living costs, consumers still have the cash level, which supports the economy.

👇 9) Politics: Donald Trump is likely claiming the Republican nomination for the 2024 election. As his chances to be elected are pretty high, the market will speculate that SEC Chair Gary Gensler will not become Treasury Secretary, and a new SEC Chair could be more crypto-friendly.

👇 10) Crypto: The more robust stock market should also benefit crypto, and we think Bitcoin could rally into year-end. Our December 2023 price target of 45,000 remains firm.

Exhibit: Bitcoin prices will likely have a big move soon